32+ take home pay calculator hawaii

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The table below details how Hawaii State Income Tax is calculated in 2023.

Pdf Estimation Of Population Mean In Successive Sampling By Sub Sampling Non Respondents Sunil Bhougal Academia Edu

Web Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

. Web To calculate your net pay or take-home pay in Hawaii enter your period or annual income along with the required federal state and local W4 information into our. Simply enter their federal and state W-4. Once done the result.

Web What is the income tax rate in Hawaii. The state income tax rate in Hawaii is progressive and ranges from 14 to 11 while federal income tax rates range from 10 to 37. Simply follow the pre-filled calculator for Hawaii and identify your withholdings allowances and filing status.

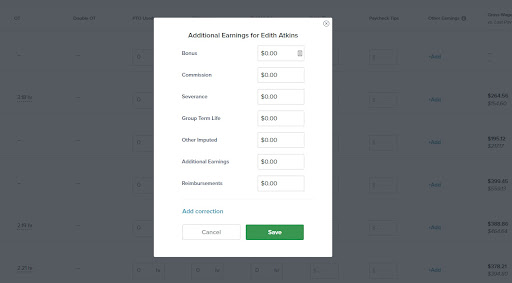

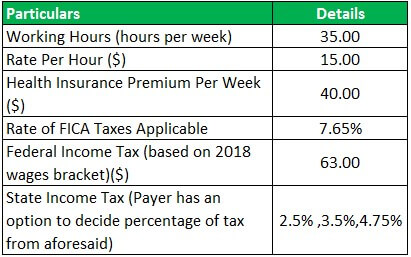

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Hawaii. The Income Tax calculation for Hawaii includes. Web As an employer in Hawaii you have to pay unemployment insurance to the state.

Well do the math for youall you. Web Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used.

Web Hawaii State Tax Calculation for 7500000 Salary. Your average tax rate is 1167 and your marginal tax rate is 22. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Hawaii.

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Web Hawaii Income Tax Calculator 2022-2023 If you make 70000 a year living in Hawaii you will be taxed 12921. Web Salary Paycheck Calculator Hawaii Paycheck Calculator Use ADPs Hawaii Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web How do I use the Hawaii paycheck calculator. The 2023 tax rates range from 17 to 62 on the first 56700 in wages paid to.

Take Home Pay Up 4 9 Take Home Pay Up 4 9 United States Joint Economic Committee

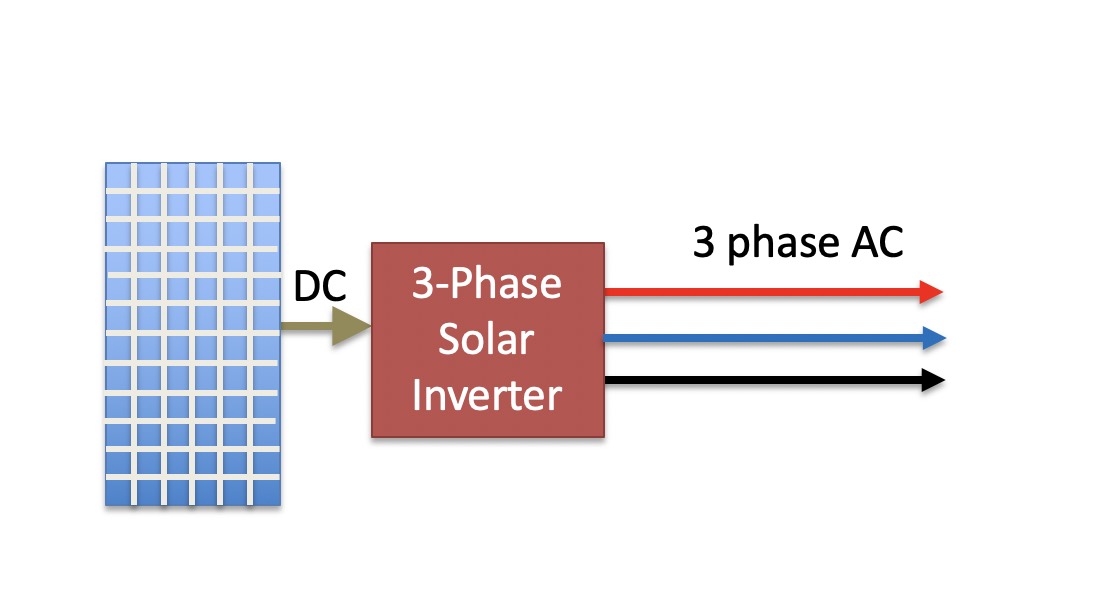

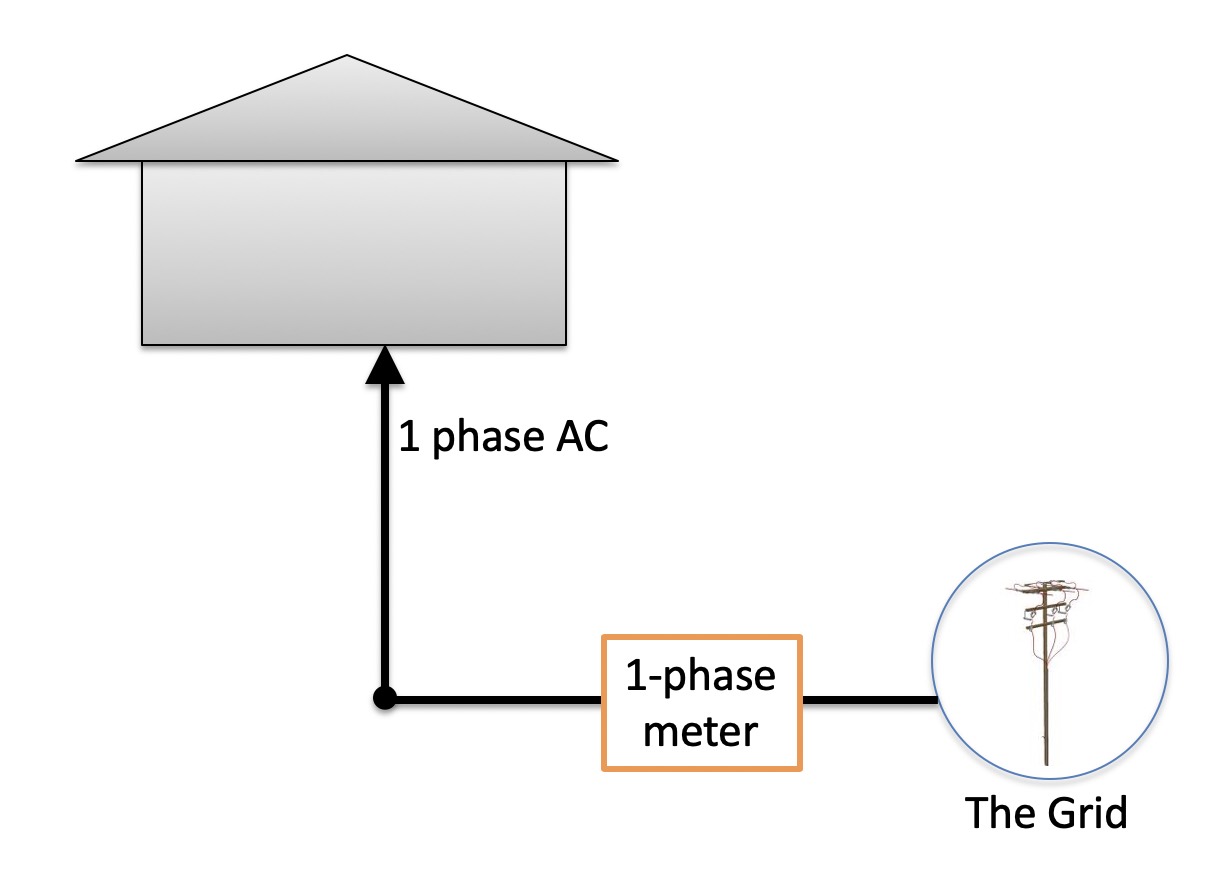

Should You Get A Three Phase Solar Inverter Solarquotes Blog

Hawaii Income Tax Calculator Smartasset

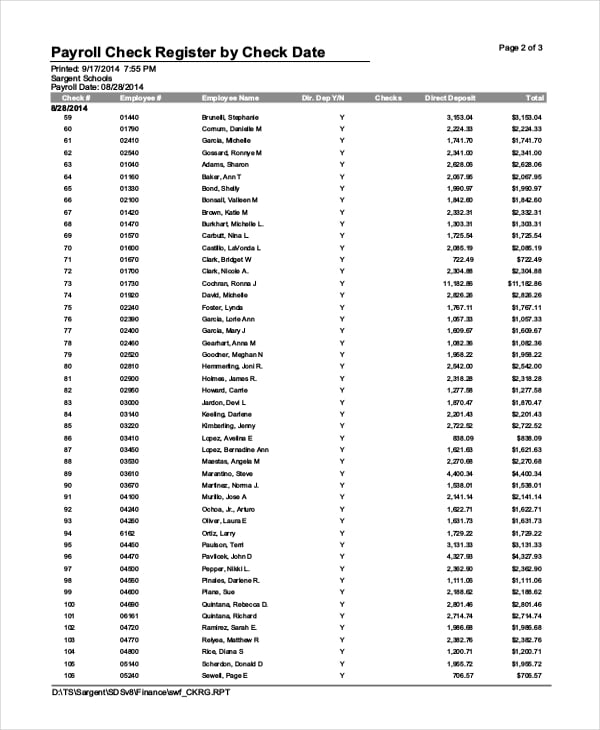

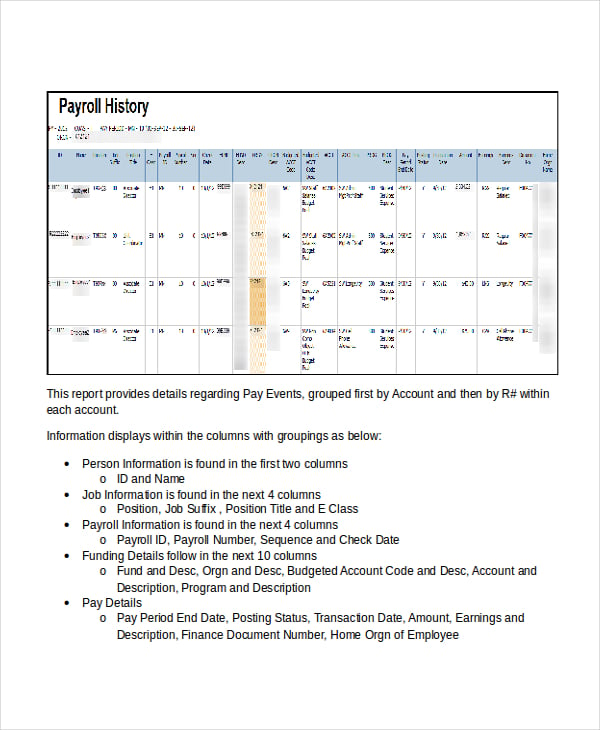

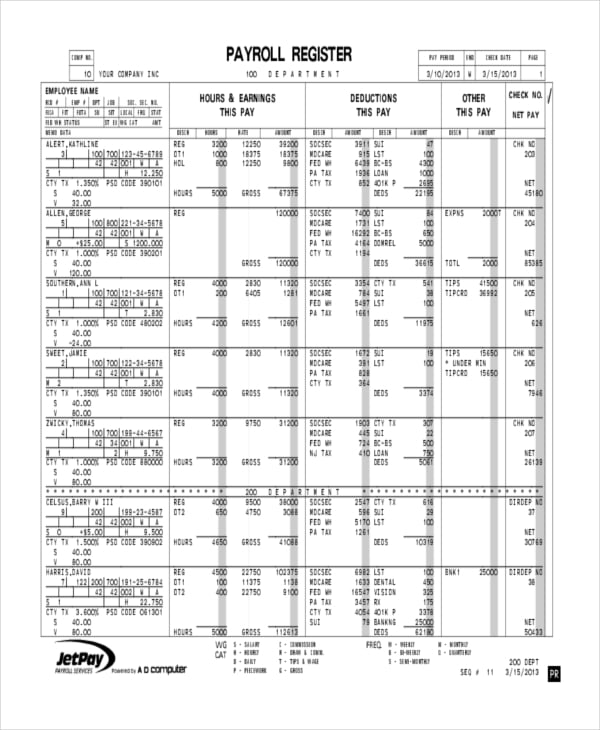

Payroll Register Template 7 Free Word Excel Pdf Document Downloads

Payroll Register Template 7 Free Word Excel Pdf Document Downloads

Payroll Register Template 7 Free Word Excel Pdf Document Downloads

32 Tips On Moving To Miami Fl Relocation Guide 2023

Bonus Pay How To Calculate Work Bonuses And Tax In 2023

What Is 32 000 After Tax In Hawaii For 2023

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Wuju Catalogo 2020 By Wuju Issuu

Should You Get A Three Phase Solar Inverter Solarquotes Blog

Compute Gazette Issue 22 1985 Apr By Zetmoon Issuu

Lokahi Apartments 73 4411 Kakahiaka Street Kailua Kona Hi Rentcafe

Jlab Go Air Pop True Wireless In Ear Headphones Slate Okinus Online Shop

Take Home Pay Definition Example How To Calculate

Math In Society Lippman Clifford Pdf Argument Deductive Reasoning